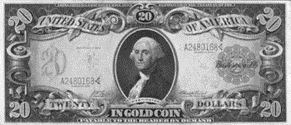

Prior to World War II, most of the world's major currencies were based on the gold standard, meaning that if you had a dollar bill in your pocket, you had the right to turn it in for an equivalent amount of gold. You've probably heard of it before, most likely from an off kilter uncle who is constantly advising you to de-bank before hyperinflation kicks in. Under the gold standard, the only way a country was able to increase its supply of money was either via digging more gold out of the ground, hence why gold rushes were such big deals, or via trade. For a long period of history all trade was done with gold. However, people quickly got sick of lugging it around, due to it being heavy as shit, and instead came up with the idea that they could just carry around pieces of paper that represented the gold. Hence paper money was born. By the early twentieth century this caused a huge debate amongst economists, which was likely every bit as exciting as you imagine it, with some claiming the gold standard was needed since money needs to be based on something solid and real, and others saying that gold was just a stupid shiny rock which we had decided was valuable, so we might as well save ourselves some time and just use paper with dead guys pictures on it instead.

By the 1920's, most countries were working off of a system where paper money could be traded in for a set amount of gold held by the government. When the Great Depression hit, many countries attempted to boost trade by declaring that an ounce of gold could buy an increasingly large amount of their paper currency, which was pretty sweet for those with gold, but pretty shitty for those who had paper money. This caused many people to hoard gold, which forced the governments to declare gold could buy even more of their paper money, which continued in a complete shit cycle that ended with many countries running out of gold, forcing them to abandon the gold standard. Then came World War II, which completely fucked up the works, given that killing large amounts of people can get rather expensive. Luckily for the Allies, the U.S. was more than willing to sell them all the guns and bombs they wanted, with the caveat that they had to pay for the means of death with gold. What all this means is that by the end of the war pretty much the entire world was off the gold standard, and even if they wanted to go back, it was impossible, given that the U.S. pretty much had all the gold. Most of the world economy was running entirely off of people believing little pieces of paper had value, and that made many people decidedly nervous.

To decide what to do next, the western world sent its most learned men (this was the 1940's and sexism was strictly enforced) to a fancy hotel in a little bum fuck town in New Hampshire called Bretton Woods. The mission of these men was to create a new world monetary system to replace the gold standard. You know, no big deal. The top minds of the world agreed that the best thing to do was to create an international currency. However, the U.S. was not really down with the idea, and since they had all the gold and therefore didn’t have to give any fucks, they instead forced everyone to go along with a system where all the other currencies were pegged to the U.S. dollar, which was the only currency still convertible to gold. This in essence switched the basis of global trade, and therefore the global economy, from gold to the U.S. dollar. The unhappy delegates called this new system the Bretton Woods System, because when your designing the new world economy you might as well name it after the hotel your staying in. Exactly how stupid this all was became apparent rather quickly.

The first problem that reared its ugly head was the fact that nobody had dollars. The U.S., thanks to being the only major industrial nation to not be devastated by the war, was a huge exporter, which meant it was taking in dollars, not sending them out. To solve this problem, the U.S. began huge foreign aid programs, starting with the Marshall Plan, giving away what amounted to billions of dollars. Now you might think this sounds weird, because it was. However, this gave the U.S. unprecedented world power throughout the 1950's and 1960's. If a country wanted to participate in the world economy they needed U.S. dollars to trade. However, the only way to get U.S. dollars was to receive U.S. foreign aid, which meant that the country damn well better do whatever the U.S. told them to do. The second problem was that though the U.S. dollar was pegged to gold, the metal was still traded freely on an open market, meaning that if the U.S. experienced an economic slowdown, people could simply claim gold from the U.S. government at a set price and then sell it for more on the open market. Over time this became a common practice for the nations who were sick of getting bossed around.

What happened next is complicated in a way that gets economists all hot and bothered, but puts everyone else to sleep. As the world moved through the 1960's, global trade became increasingly competitive, which in turn led to a slowdown in the U.S. economy. At the same time, the American government spent a shit ton of money on the Vietnam War and generous social programs at home, making less available for foreign aid. This led to a deterioration of the U.S. gold reserve, which made it impossible to maintain the exchange rate between the dollar and gold. In 1971, the U.S. went off the gold standard and the Bretton Woods System collapsed. Today, the world economy is based on everybody believing that little pieces of paper with dead people printed on it have value.

Image: https://commons.wikimedia.org/wiki/File:US_$20_1905_Gold_Certificate.jpg